2.5. The Project Budget

2.5.1. Allocating Contingency

Project teams can choose to incorporate contingency time or cost into an overall schedule or budget to allow for schedule risk. For example, the contingency time can be a percentage of the estimated activity duration, a fixed number of work periods, or it can be developed by quantitative risk analysis. The reserve time or cost can be used completely or partially, and can later be reduced or eliminated as more precise information about the project becomes available. The reserve time or cost should be documented along with other data and assumptions.

Time contingency on critical path activities will affect the overall project duration, whereas contingency on noncritical path activities may move them onto the critical path and, in turn, affect project duration. This has an impact on the project deliverables and milestones.

Many estimators include contingency allowances for cost and time in activity estimates. There is an inherent problem with this approach, specifically, of not identifying the original activity estimates and thereby enabling the typical human response of consuming all assigned time and budget.

One possible solution to this problem is to combine the contingency time and resources, including cost for a group of related activities, into a single contingency activity (or contingency buffer) that is intentionally placed directly on the path for that group of activities.

The diagram in the slide shows the expected funding for the project. The project manager can be invaluable in providing the information necessary to support funding requests that will ensure a positive funding flow in advance of expenditures.

Many projects, particularly larger ones, have multiple cost baselines to measure different aspects of cost performance. For example, management will require that the project manager track internal costs (employee labor) separately from external costs (subcontractors and construction materials).

Private sector budget processes are very similar to the government budget processes. They must respond quickly to market challenges from competitors. Therefore, large private firms frequently delegate detailed budget decisions to smaller cost centers. The manager of each cost center has clear performance measures – make profit, satisfy customers, and obey the law.

As the activities progress through execution, it is possible to adjust the contingency activity, as measured by the time, cost, and resource consumption of the activities.

This means that the activity variances for the related activities are more accurate as they are based on the original estimates, and the contingency used or unused can also be measured in time, cost, and resource consumption.

By using contingency activities in this way, there is a resultant clarification of contingency time, cost, and resources. These contingency activities can follow on from each activity for which a significant contingency is needed or as a composite contingency for all activities in a work package.

Contingency reserve is the amount of money or time needed above the estimate to reduce the risk of overruns of project objectives to a level acceptable to the organization.

Contingency reserves are budgeted costs that can be used at the direction of the project manager in order to deal with anticipated, but not certain, events. These are “known unknowns” and are part of the cost base line.

Contingency reserves are usually assigned at the work package level as a zero duration summary activity, spanning the start to the end of the work package sub-network.

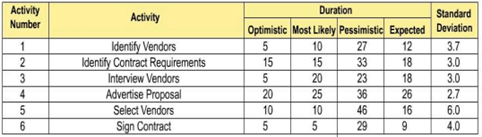

On the next page, the optimistic, most likely and pessimistic estimates are displayed for the project to sign a contract. Given this data, and the application of PERT, the expected durations and standard deviation can be calculated.

From the table below you can see that the standard deviation for the ‘Select Vendors’ activity is higher than any other activity. (The standard deviation is a measure of the dispersion of possible outcomes.)

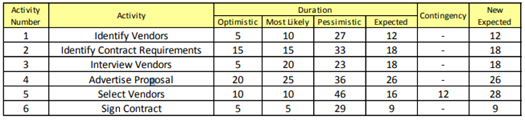

Contingency should be allocated to this activity within the expected and pessimistic boundaries (i.e. 16 weeks to 46 weeks).

Based on PERT calculations, the higher the duration of the activity, the less risk is associated with it and in turn, the higher the confidence of completing the activity. For this activity, an extra 12 weeks is allowed – see table below. This is a selection based on high standard deviation associated with the activity. The project can select:

- one standard deviation of contingency = 6 weeks

- two standard deviation of contingency = 12 weeks

- three standard deviation of contingency = 18 weeks

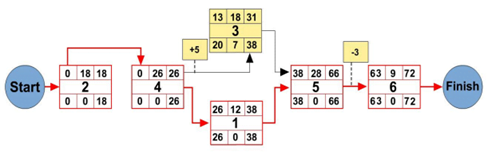

The project duration is now 72 weeks with the applied contingency:

In the context of contingency activities, one of the most important techniques is that of simulation. Simulation involves the calculation of multiple project durations with different sets of activity assumptions. The most common simulation technique is Monte Carlo Analysis.

Monte Carlo simulation provides an alternative calculation method when there are

- many significant uncertainties and contingencies

- outcome probability distributions are required to compare risk-versus-value profiles

- complex profiling of time and cost distributions

Monte Carlo is a random number generating algorithm that is the basis of simulation. In a Monte Carlo Analysis, a distribution of probable results is defined for each activity and used to calculate a distribution of probable results for the total project.

2.5.2. Cost Budgeting and Baseline

Cost estimating is the development of an approximation (estimate) of the costs of the resources needed to complete project activities. In approximating cost, the estimator first needs to consider the causes of variation of the final estimate for purposes of better managing the project.

When a project is performed under contract, care should be taken to distinguish between cost estimating and pricing. Cost estimating involves developing an assessment of the likely quantitative result whereas pricing is the value that is placed on a market commodity. An estimate is the initial basis for deriving a price, however, a number of iterations of understanding the accuracy of estimates should be completed before presenting a price. A normal occurrence is with contracting, where a number of iterations of functionality / job estimation are performed before delivering a final price.

Cost estimates are quantitative assessments of the likely costs of the resources required to complete project activities. Costs need to be estimated for all resources that will be charged to the project. These include labor, materials, supplies, and special categories such as an inflation allowance or cost reserve to projects. Cost estimates are generally expressed in units of currency to facilitate comparisons both within and across projects. In some cases, the estimator may employ units of measure, such as staff hours or staff days, along with their cost estimates to facilitate appropriate management control.

Cost estimates may need to be refined during the project to reflect the additional detail available. In some application areas, there are guidelines for when such refinements should be made and what degree of accuracy is expected. It takes account of appropriate risk response planning, such as contingency plans.

The estimator needs to figure out

- how much it will cost the performing organization to provide the product or service

- how much the performing organization will charge for the product or service

Cost estimating also involves identifying and considering various costing alternatives. For example, in most application areas, additional work during a design phase is widely held to have the potential for reducing the cost of the production phase. The cost-estimating process must take into account whether or not the cost of the additional design work will be offset by the expected savings.

Cost estimating involves developing an approximation (estimate) of the costs of the resources needed to complete project activities.

Estimation is a skill acquired over time. Project managers can achieve more realistic estimates if they take certain items into consideration. These include

- the Work Breakdown Structure – this is used to organize the cost estimates and to ensure that all identified work has been estimated

- resource requirements –the types of resources (people, equipment, materials) and the quantities required to perform project activities

- resource rates – the individual or group preparing the estimates must know the unit rates (e.g., staff cost per hour, bulk material cost per cubic yard) for each resource to calculate project costs. If actual rates are not known, the rates themselves may have to be estimated.

- activity duration estimates – these will affect cost estimates on any project where the project budget includes an allowance for the cost of financing (i.e., interest charges).

The tools and techniques involved in estimating costs include

- analogous estimating – uses the cost of previous, similar projects to estimate the cost of a similar project

- parametric modeling – uses project parameters in a mathematical model to predict project costs

- bottom-up estimating – involves estimating the cost of individual project activities and aggregating results to get total project cost

- computerized tools – project management software, spreadsheets, simulation and statistical tools are all widely used to assist with cost estimation

- other cost estimating methods – for example, vendor bid analysis

- estimating publications – commercially available data on cost estimating

- historical information – information on the cost of many categories of resources is often available from one or more of the following sources:

- project files – one or more of the organizations involved in the project may maintain records of previous project results that are detailed enough to aid in developing cost estimates. In some application areas, individual team members may maintain such records

- commercial cost-estimating databases – historical information is often available commercially

- project team knowledge – the individual members of the project team may remember previous actuals or estimates. While such recollections may be useful, they are generally far less reliable than documented results

- chart of accounts – a chart of accounts describes the coding structure used by the performing organization to report financial information in its general ledger. Project cost estimates must be assigned to the correct accounting category.

- risks – the project team considers information on risks when producing cost estimates, since risks (either threats or opportunities) can have a significant impact on cost. The project team considers the extent to which the effect of risk is included in the cost estimates for each activity.

Representative bodies in large governments usually assign funds to programs rather than to individual projects (see Government Extension to the PMBOK® Guide Third Edition; Chapter 1). They set the rules for how funds are to be divided among individual programs. If the representative body budgets by program, each project must be funded from one or more of these programs.

Similar situations are common wherever new facilities are budgeted separately from rehabilitation. It generally makes sense to have a single contractor carry out both the new work and the rehabilitation at a particular location. This minimizes the overhead cost of developing and managing multiple contracts, as well as minimizing the disruption to the occupants of the facility.

On government projects, there are several additional tools used when cost budgeting (Government Extension to the PMBOK® Guide Third Edition; Chapter 7). These include:

- split funding by program

- matching funds

- split funding by fiscal year

Split funding means that a single project receives financial contributions from more than one program.

There are three possible methods of split funding by program.

- Defined Elements of Work method, each program only pays for the elements that it wants. To the representative body, this would appear to make it the best choice. This method requires a detailed manual accounting system, however, because an automated system can seldom discern which elements are being worked on. Such a manual process is prone to inaccuracy, requires a large commitment of time for reporting and auditing, and has increased costs that generally outweigh the slight increase in the accuracy of charges.

The Defined Elements of Work method also requires a far more detailed WBS than the other two methods. To capture each program’s portion accurately, the WBS must be defined to a level where each program’s portion maps uniquely to a set of WBS elements. This level of detail is generally far greater than what is needed to manage the project.

- Defined Contribution method does not require an amendment to the WBS. Usually, it is established as a “percentage split”. When the limit is reached for the fixed programs, the split is changed to a 100 percent payment by the risk-bearing program. If the project is completed within budget, the change never occurs.

- Percentage Split is the simplest approach. The contribution of each program is estimated at the start of the project. On the basis of that estimate, each program bears its percentage of the project cost. As programs fund many projects, variances on one project will probably be counterbalanced by opposite variances on other projects.

Matching funds are a form of split funding by program. When governments delegate project selection to lower representative bodies, they often require those lower bodies to pay a portion of the project cost. This is designed to ensure that the lower government is committed to the project. Matching funds may be apportioned on a percentage basis or as a defined contribution.

If a project begins in one fiscal year and ends in another, it will need funding from the budget of each fiscal year in which there is project work. This split funding by fiscal year can be decreased through obligations, if the representative body allows them.

Funding by fiscal year requires that project managers plan their work by fiscal year with great care. This is particularly true in large governments with many levels of review.

Fortunately, funds are generally appropriated to programs rather than individual projects. This means that project managers can use funds from projects that underrun their fiscal year budgets to fund the overruns in other projects. These are fiscal year variances, not variances in the total cost of the project.

However, fiscal year funding can occasionally have the opposite effect to what is intended. While annual budgets are intended to establish limits on the executive, a focus on fiscal years can also divert attention away from overall multiyear costs. This can result in projects incurring large overall cost overruns without the representative body being aware of the fact. To avoid this problem, representative bodies should demand multiyear reports.

The activity cost estimates are aggregated by work packages in accordance with the WBS. The work package cost estimates are then progressively aggregated for the higher component levels of the WBS and ultimately for the entire project. Cost Baseline

The cost baseline is a time-phased budget that is used to measure and monitor overall cost performance on the project. It is developed by summing the estimated costs by period and is usually displayed in the form of an S-curve